We approach every deal with a uniquely tailored approach, and strive to leave each property better than we found it.

Tampa, FL

Luxe at 1820

Charlotte, NC

Thrive University City

Manassas Park, VA

Palisades at Manassas Park

Washington, DC

Connecticut Plaza

Washington, DC

The Conwell

Durham, NC

Haven at Patterson Place

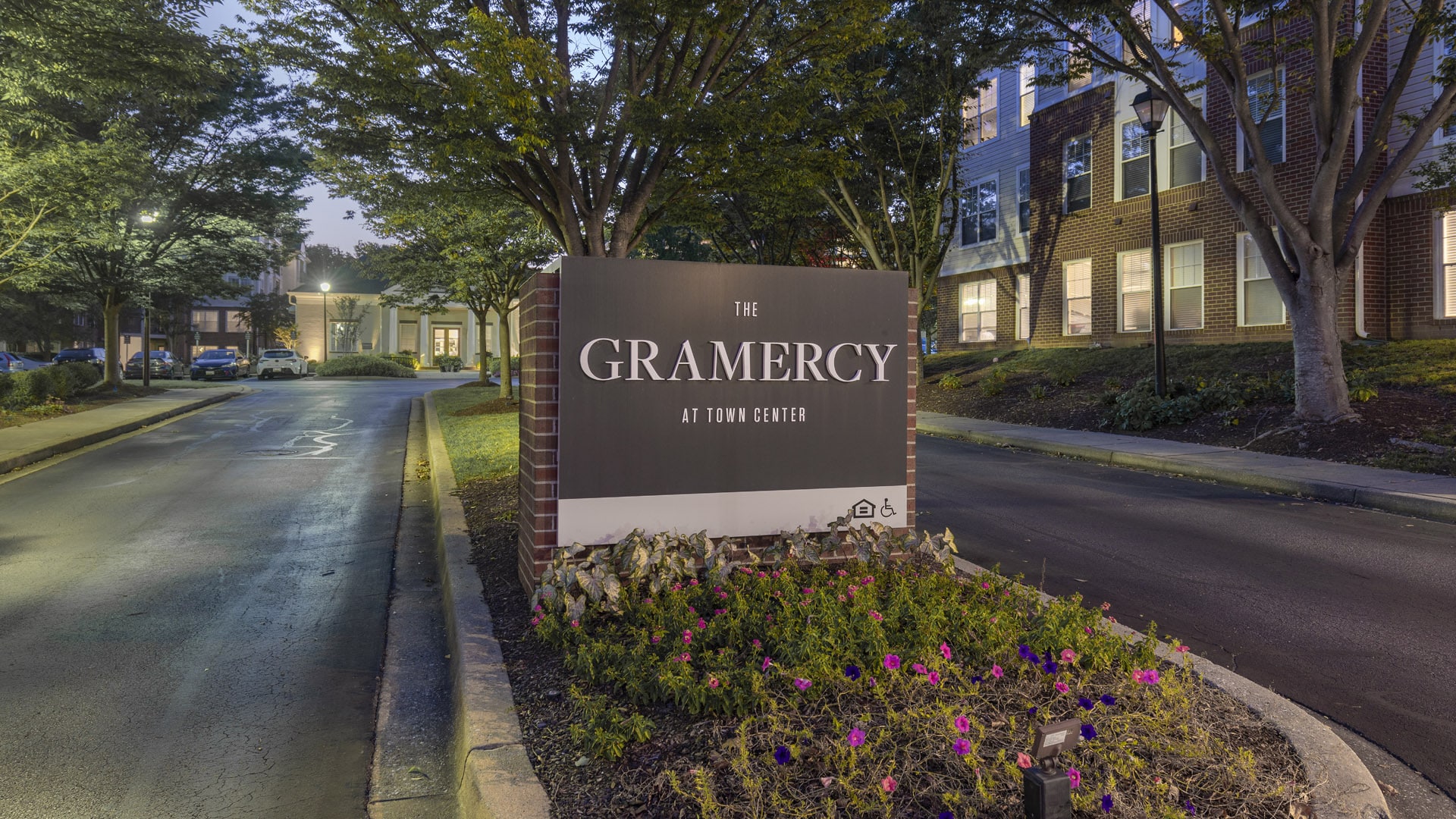

Columbia, MD

Gramercy at Town Center

Raleigh, NC

Columns at Wakefield

Atlanta, GA

550 Abernathy

Charlotte, NC

Magnolia Terrace

Atlanta, GA

River Vista

Durham, NC

Trails at Southpoint Glen

Odenton, MD

Seven Oaks

Pembroke Pines, FL

Marquesa

Atlanta, GA

Landry at East Cobb

Washington, DC

Glenwood Apartments

Durham, NC

Southpoint Glen

Atlanta, GA

Veridian at Sandy Springs

Clearwater, FL

Enclave at Northwoods

Richmond, VA

Copper Springs Apartments

Columbia, MD

Beech's Farm Apartments

Atlanta, GA

Spalding Crossing

Dallas, TX

Lakepointe Apartments

Baltimore, MD

Banner Hill

Capitol Heights, MD

Woods at Addison

Orlando, FL

Baldwin Harbor

Forestville, MD

Holly Springs

Washington, DC

The Shelby

Suitland, MD

Capital Crossing

Washington, DC

Shelburne

Dallas, TX

Cross Creek Apartments

Tampa, FL

Arbors at Branch Creek

Washington, DC

Spring Valley Flats

Capitol Heights, MD

Capital Courts

Washington, DC

The Policy

Dallas, TX

Monarch

Washington, DC

The Sedgewick

Frederick, MD

Brooklawn Apartments

Washington, DC

Brightwood Portfolio